Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- A collection of positive and negative news that affects the foreign exchange mar

- The US dollar index range fluctuates, focusing on Jackson Hole annual meeting

- XM creates a new benchmark for transaction security through global compliance an

- U.S. sanctions on Iranian oil revenue boost oil prices, firmly betting on the Fe

- Gold focuses on further testing weekly support, Europe and the United States are

market news

Weekly "small non-agricultural" data shows employment weakness continues, gold prices rebound from one-week low

Wonderful introduction:

Youth is a nectar made with blood drops of will and sweat of hard work - it will last forever; youth is a rainbow woven with unfading hope and immortal yearning - it is brilliant and brilliant; youth is a copper wall built with eternal persistence and tenacity - it is impregnable.

Hello everyone, today XM Forex will bring you "[XM Forex Platform]: "Small non-agricultural" weekly data shows that employment weakness continues, and gold prices rebound from a one-week low." Hope this helps you! The original content is as follows:

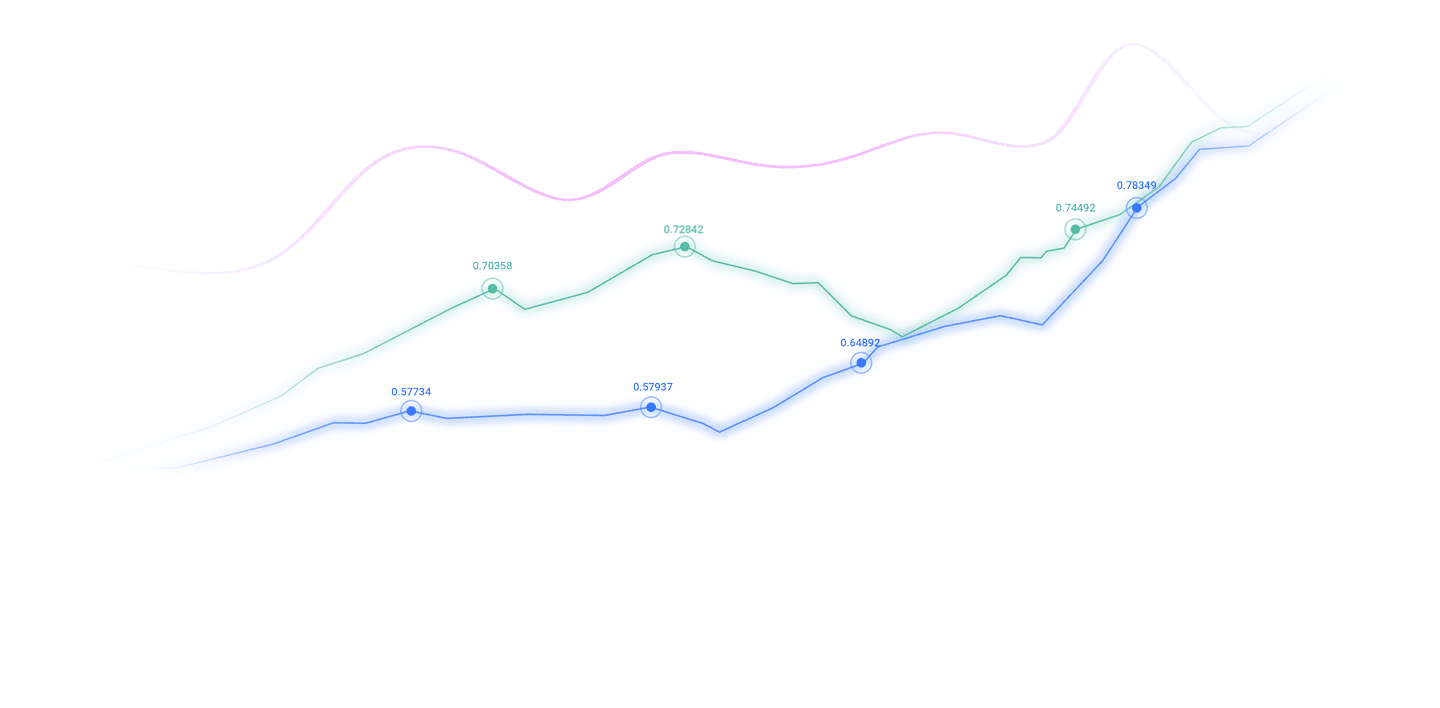

On November 19, in early trading in the Asian market, spot gold was trading around US$4,072 per ounce. Gold hit a one-week low on Tuesday and then rebounded. Mainly driven by weak U.S. employment data, which strengthened market expectations that the Federal Reserve may cut interest rates in December; U.S. crude oil traded around $60.68 per barrel. Oil prices fluctuated and closed higher on Tuesday under the influence of multiple factors. U.S. President Trump announced that he had started interviews for the next chairman of the Federal Reserve, boosting market risk appetite.

The U.S. dollar continued its gains against the yen on Tuesday, hitting a nine-and-a-half-month high during the session, and also strengthened against the euro. Market concerns about Japan's fiscal policy continue to simmer, while investors are waiting for key U.S. data to provide clear direction for the Federal Reserve's policy path.

The U.S. dollar index edged up 0.02% to 99.55. The U.S. dollar index rose 0.2% against the yen to 155.58 yen. It hit 155.73 in the morning, the highest level since February 3. The euro fell 0.07% against the U.S. dollar to 1.1584 U.S. dollars.

The strength of the US dollar is mainly due to two factors. In Japan, although Bank of Japan Governor Kazuo Ueda hinted that he may raise interest rates as early as next month, Prime Minister Takaichi Sanae expressed dissatisfaction with this and asked the central bank to cooperate with the government to revive the economy. This policy disagreement triggered market concerns about Japan's fiscal discipline. Barclays Bank analysis believes that Prime Minister Takaichi's implementation of Abenomics-style policies will continue to put pressure on the yen.

In the United States, recent data show signs of economic slowdown, but expectations for interest rate cuts are weakening. Cleveland Fed data shows 39,000 Americans received layoff notices last month, ADThe P report shows employers are cutting an average of 2,500 jobs a week. Strategists pointed out: Looking at the market on paper, there is really no reason to cut interest rates at the moment.

Market focus turns to the U.S. September employment report expected to be released on Thursday, which will provide important clues to the Fed's next move. The money market currently predicts that the probability of a 25 basis point interest rate cut next month is about 51%, which is significantly lower than last week's 60%. Opinions remain divided within the Fed, with Governor Waller continuing to find reasons for cutting interest rates, while Vice Chairman Jefferson advocated the need to "move slowly."

Asian Markets

Australia’s wage and price index rose 0.8% year-on-year in the third quarter, in line with expectations and keeping pace with the second quarter. Overall stability masked slight changes across sectors: private sector wages rose 0.7% month-on-month, while public sector wages rose 0.9% month-on-month, continuing recent outperformance.

On an annual basis, wage growth was 3.4%, the same as in the second quarter. Public sector pay rose 3.8% year-on-year, slightly higher than last year's 3.7% increase. Private sector wage growth slowed to 3.2% from 3.5% in September 2024. This is the third consecutive quarter that public wages have grown faster than private wages.

European Markets

Hugh Peel, chief economist at the Bank of England, warned against placing too much emphasis on a single data point.

In a panel discussion, he said: "Policymakers should be careful about over-interpreting the latest data news because there is a lot of noise in the data flow, partly due to some of the challenges faced by colleagues at the Office for National Statistics."

Peel said he acknowledged that underlying inflationary pressures may not be as strong as the 3.8% headline inflation rate suggests. However, he cautioned that other inflation-related data had not slowed as much as expected.

U.S. market

Inflation in Canada slowed down in October, with overall CPI slowing from 2.4% to 2.2% year-on-year, fully in line with expectations. The slowdown was mainly driven by gasoline prices, which fell 9.4% year-on-year, xmmen.compared with a 4.1% decline in September. Excluding gasoline, the consumer price index (CPI) remained at 2.6% year-on-year.

The performance of core indicators is xmmen.complex but overall soft. The median CPI fell to 2.9% from 3.1%, below expectations of 3.1%. CPI decreased to 3.0% year-on-year, from 3.1% to 3.0%, in line with expectations. CPI xmmen.common Shares were flat at 2.7% year over year, missing expectations of 2.8%.

Data showed inflation will gradually cool, driven mainly by energy, but supported by a slight softening in core categories.

Thomas Barkin, President of the Federal Reserve Bank of Richmond, said that the U.S. central bank is facing pressure from both sides, with inflation still above the target and employment growth slowing down significantly. However, he noted that the situation was not one-sided, with consumers increasingly resisting price increases while shrinking labor supply kept the unemployment rate stable.

Barkin described the Fed’s current environment as “a ship docked at night.”But there is no beacon," underscoring the difficulty of judging policy in the absence of timely government data during the shutdown. He said the upcoming delayed report will provide much-needed clarity on inflation and labor market dynamics.

"I think we still have a lot to learn between now and then," he added, pointing to December The decision remains heavily data-dependent as policymakers await the first full set of data since the government reopened. Fed President Christopher Waller struck a distinctly dovish tone in an overnight speech, arguing that inflation risks have receded and worsening labor conditions now deserve more attention. Waller said he was "not concerned." "Inflation is accelerating," adding that this week's September jobs report or upcoming news is unlikely to change his view on "another cut" after months of cooling employment data. He warned that restrictive monetary policy has disproportionately burdened low- and middle-income consumers, further supporting easing.

Waller said December's cuts will Providing "additional insurance" against further labor market deterioration and helping policy move toward neutral

Separately, Vice Chairman Philip Jefferson provided a more balanced view in his speech, acknowledging that policy has been gradually guided towards the neutral rate. He added: "The evolution of the balance of risks emphasizes the need to move slowly towards neutral rates. "

The above content is all about "[XM Foreign Exchange Platform]: "Small non-agricultural" weekly data shows that employment weakness continues, and gold prices rebound from a one-week low". It was carefully xmmen.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to you The transaction is helpful! Thank you for your support!

In fact, responsibility is not helpless, it is as colorful as a rainbow. It is this colorful responsibility that creates our wonderful life today.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here