Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Gold is under pressure as scheduled, Europe and the United States first pay atte

- Gold focuses on further testing weekly support, Europe and the United States are

- The daily line is connected to the lower track, gold and silver are short first

- Five major events to happen in the global market this week

- Gold, repair bulls!

market analysis

Expectations for the Federal Reserve to cut interest rates in December cooled, and the U.S. dollar index fluctuated around 99.50

Wonderful introduction:

The breeze in one's sleeves is the happiness of an honest man, a prosperous business is the happiness of a businessman, punishing evil and hoeing an adulterer is the happiness of a knight, being good in character and learning is the happiness of a student, helping those in need and those in need is the happiness of a good person, sowing in spring and harvesting in autumn is the happiness of farmers.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Decision Analysis]: The Fed's December interest rate cut expectations have cooled, and the U.S. dollar index has fluctuated around 99.50." Hope this helps you! The original content is as follows:

The U.S. dollar index hovered around 99.58 in Asian trading on Tuesday. The U.S. dollar rose against the euro and yen on Monday as traders remained cautious ahead of the release of long-awaited U.S. economic data. As the federal government shutdown ends, a raft of delayed data will be released this week, including Thursday's September non-farm payrolls report, which will provide important clues about the health of the world's largest economy. While the short-term data may be of limited value due to being out of date, in the medium term, they may still indicate downside risks to the labor market enough to quell the debate within the Fed. With the release of key data one after another, the foreign exchange market may end the recent range-bound pattern.

Analysis of major currency trends

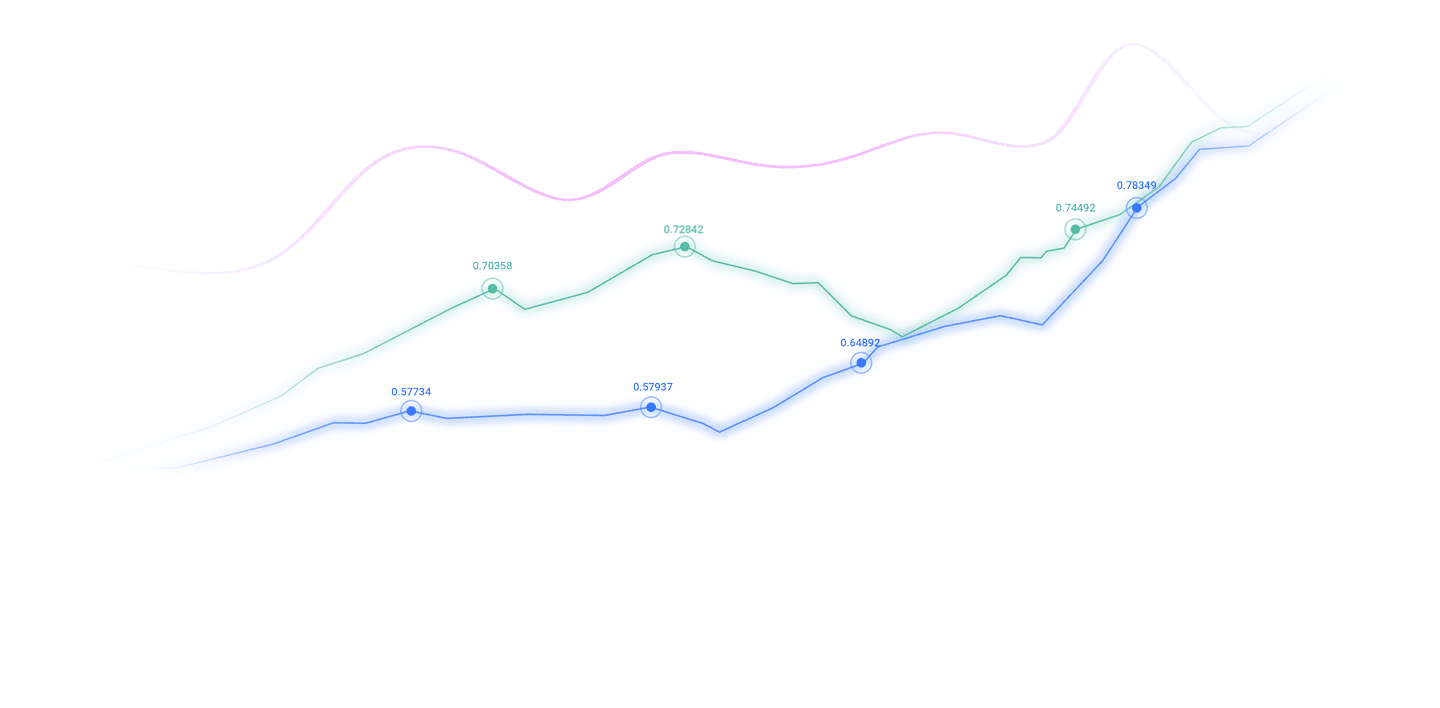

U.S. dollar: As of press time, the U.S. dollar index is hovering around 99.58. Risk aversion has supported the U.S. dollar as the U.S. government resumes releasing a large amount of data and will release a non-farm employment report on Thursday. The U.S. Bureau of Labor Statistics (BLS) will release these data, along with actual earnings data on Friday. Meanwhile, investors bought the U.S. dollar on concerns about a possible artificial intelligence bubble, with Nvidia due to report earnings on Wednesday, which could affect sentiment, especially ahead of key U.S. data. Technically, the MACD double lines are above the zero axis but flattening, and the energy of the bars has converged, indicating that the upward momentum has slowed down and the trend is still bullish. The RSI is about 56, which is neutral to strong and not overheated. Below, focus on the 99.30 area where the channel coincides with the horizontal line. If it falls back below it, the rhythm may turn into a range-bound shock; if the volume and price cooperate to break through 99.48 and stabilize, the upper edge of the channel may point to 99.66. The overall trend is still mainly high and low switching within the channel, focusing on the 99.30-99.59 area.breakthrough direction.

1. The UK announced a reform plan for the asylum system and will xmmen.comprehensively tighten refugee policies

On the 17th local time, the British government issued a document announcing a xmmen.comprehensive reform plan for the asylum system. It will implement stricter control measures in asylum applications, refugee identification, family repatriation, financial support and other aspects. The reform was proposed by Home Secretary Mahmoud and is regarded by the outside world as an important step in tightening the UK's immigration and asylum policies. The British government stated that this round of reforms aims to "reduce the attractiveness of the UK to illegal immigrants" and "ensure that those who have no right to stay in the UK can be quickly deported." Relevant measures will still be further solicited for opinions and implemented one after another.

2. People familiar with the matter: The UK is formulating countermeasures against EU steel tariffs

According to US media reports, the UK is formulating countermeasures when British Prime Minister Starmer is unable to reach an agreement to mitigate the impact of the EU's proposed steel tariff increase. People familiar with the matter revealed that the British domestic metals industry had previously warned that Europe's plan could trigger the biggest crisis in its history, prompting the British government to consider retaliatory actions. The EU unveiled plans last month to cut existing tariff-free quotas for foreign steel by nearly half and double taxes on excess quotas to 50%. The British government is also studying how to speed up the replacement of its own steel safeguards and tighten import quotas, people familiar with the matter said. These current measures are due to expire in June. The British government said in a statement: "This government has demonstrated its xmmen.commitment to the steel industry by ensuring exporters have priority access to the US market, and we will continue to explore stronger trade measures to protect our steel producers from unfair practices, while reiterating our desire to tackle overcapacity in the industry. Following the recent EU announcement We will continue to contact them after the measures are announced."

3. Fed's mouthpiece: There will be at least three objections to whether to cut interest rates in December

"Fed's mouthpiece" Nick Timiraos pointed out in the article that Fed officials face a challenge, that is, how to resolve differences on interest rates. He cited two camps within the Fed, one more worried about inflation, a group that has expanded recently and includes four regional Fed presidents with voting rights this year, as well as Fed Governor Barr. Another group of officials, including all three Trump-appointed Fed governors, are more worried about the labor market. They worry that their colleagues will overemphasize the dangers of persistently high inflation, leading to unnecessary risks of recession, and that they believe that high inflation is far away. Nick said that in any case, there may be at least three dissenters at the December meeting. Three Trump-appointed officials will oppose keeping interest rates unchanged; and if the Fed cuts interest rates by 25 basis points, the number of objections will be at least three.

4. Federal Reserve Governor Waller: Supports a risk-managed interest rate cut in December

Federal Reserve Governor Waller said he supportsHe cut interest rates again at the December meeting as he grew concerned about a sharp slowdown in the labor market and employment. Waller said: "I am not worried about accelerating inflation or a significant rise in inflation expectations. My focus is on the labor market. After several months of weakness, it is unlikely that the September employment report due later this week or any other data in the xmmen.coming weeks will change my view that another rate cut is necessary." Waller specifically pointed out that he is leaning toward another 25 basis points cut. Waller said: "I am concerned that restrictive monetary policy is putting pressure on the economy, especially its impact on low- and middle-income consumers. A rate cut in December will provide additional protection against an accelerated weakening of the labor market and move policy in a more neutral direction." At the same time, he said, price data shows that tariffs will not have a long-term impact on inflation. Another rate cut would be a risk management exercise.

5. U.S. Treasury bonds recovered some of last week’s losses. The market is betting that the recovery of data will boost interest rate cut expectations.

With British government bonds leading the gains, U.S. Treasury bonds have recovered some of last week’s losses. Despite early setbacks in corporate debt markets at the start of the week - Amazon.com Inc. issued $12 billion in U.S. dollar-denominated bonds, its first U.S. dollar bond issuance since 2022 - the rally in Treasuries has held up. Also on Monday, a measure of factory activity in New York state unexpectedly increased to its highest level in a year. Still, most Treasury yields fell 1 to 3 basis points. There had been predictions that the eventual return of federal economic statistics following the six-week U.S. government shutdown that ended last week would revive the prospect of another Fed rate cut next month. Morgan Stanley's interest rate strategists predict that the U.S. 10-year Treasury yield will fall to 3.75% by mid-2026, and may even reach 2.40% in the most bullish scenario. While the fate of some U.S. economic reports not released during the shutdown remains unclear, the Bureau of Labor Statistics said it would release September data on Nov. 20, originally scheduled for Oct. 3. The Fed cut interest rates by 0.25 percentage points in September and October in response to signs of weakening demand for labor, although inflation remains above its 2% target.

Institutional View

1. TD Securities: The normalization of the Federal Reserve's policy is expected to become a key driver of global interest rates next year

TD Securities interest rate strategists said in a report that entering 2026, the normalization of the Federal Reserve's policy will become a key driver of global interest rates. Strategists noted that market expectations for the Fed's long-term interest rates remain "stubbornly" elevated. However, as the Fed continues its rate-cutting cycle, markets will eventually revise their expectations for the longer-term federal funds rate. They said lower U.S. yields would help curb rising long-term borrowing costs elsewhere as the co-movement between global and U.S. rates remains "very strong."

2. Institutions: British budget measures may reduce the extent of interest rate cuts by the Bank of England

Kevin Timoney of Davy Research said in a report that the United Kingdom will announce a budget on November 26. If the measures included in it are not effective in curbing inflation, it may lead to the Bank of England reducing the number of interest rate cuts. Data shows that the market currently believes that the probability of the Bank of England cutting interest rates in December is 75%. UK government bond yields rose sharply last week amid concerns over the fiscal outlook, following media reports that the chancellor had abandoned plans to raise income tax in the Budget.

3. Morgan Stanley: The European Central Bank has room to further cut interest rates, and the German bond yield may be 2.45% by the end of next year.

Morgan Stanley said it expects the European Central Bank to further cut interest rates in the first half of next year. By the middle of next year, the policy rate will be cut to 1.50% from the current 2.00% and remain at that level. Strategists pointed out: "Weak economic growth, lower-than-expected inflation, and limited fiscal stimulus are all pushing the European Central Bank to further ease." Against this background, Morgan Stanley expects the 10-year German bond yield to be about 2.45% by the end of 2026. Money markets expect the European Central Bank to cut interest rates by nearly 10 basis points in June 2026, according to LSEG data.

The above content is all about "[XM Foreign Exchange Decision Analysis]: The Fed's December interest rate cut expectations have cooled, and the U.S. dollar index has fluctuated around 99.50". It was carefully xmmen.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless or boring, it is as gorgeous as a rainbow. It is this colorful responsibility that creates the wonderful life we have today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here