Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Non-farm employment data put pressure on the US dollar, and the US dollar defens

- Strong fluctuations are coming under pressure, and gold and silver need more ret

- President Trump puts further pressure on the Fed, U.S. non-farms become the focu

- Gold is still weak, and "more" needs to be waited!

- After the non-farm upset in the United States in July, why did the pound rise sh

market news

The dollar continues to collapse! The euro takes the opportunity to rush to 1.1650, will the market usher in a shocking reversal at the end of the year?

Wonderful introduction:

You don’t have to learn to be sad in your youth. What xmmen.comes and goes is not worth the time. What I promised you, maybe it shouldn’t be a waste of time. Remember, the icy blue that stayed awake all night, is like the romance swallowed by purple jasmine, but the road is far away and the person has not returned. Where does the love stop?

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market xmmen.commentary]: The US dollar continues to collapse! The euro takes the opportunity to rush to 1.1650, will the market experience a shocking reversal at the end of the year?". Hope this helps you! The original content is as follows:

On Friday (November 14), the exchange rate of the euro against the U.S. dollar remained within a volatile range. It is currently trading around 1.1650 during the North American session, rising slightly and approaching the three-week high of 1.1655 hit the previous day. Although the Eurozone's GDP data showed that economic growth is still weak, the euro performed strongly against the backdrop of the continued weakness of the US dollar, and market sentiment favored the euro bulls.

Fundamentals

The Eurozone’s GDP data provided some support for the market. Data showed that the euro zone economy grew by 0.2% in the third quarter, and the annual growth rate was revised to 1.4%, slightly exceeding market expectations. Although the euro zone's economic performance is relatively weak, this data is still optimistic for the market xmmen.compared to the economic contraction expected by some markets. The euro zone's trade surplus also expanded, further supporting the euro's gains. The trade surplus expanded to 19.4 billion euros in September, a significant increase from 1.9 billion euros in August.

At the same time, the weak performance of the US economy has also provided strong support for the euro. Although top Fed officials, including St. Louis Fed President Musalim and Cleveland Fed President Hammack, have said that inflation risks still exist and hinted that the Fed may continue to maintain high interest rate policies, the dollar has still failed to find significant support. As the window for U.S. data release is temporarily closed, the market remains cautious about the direction of the U.S. dollar.

The continued weakness of the US dollar has provided strong support for the rebound of the euro. The U.S. dollar index (DXY) has been falling for several consecutive days. Some analysts believe that this weak U.S. dollar trend may continue until the end of the year, further promoting the rise of the euro.. However, as the Fed's policy direction remains uncertain, market sentiment towards the U.S. dollar remains xmmen.complex, and the long-term trend of the U.S. dollar remains unclear.

Technical aspect:

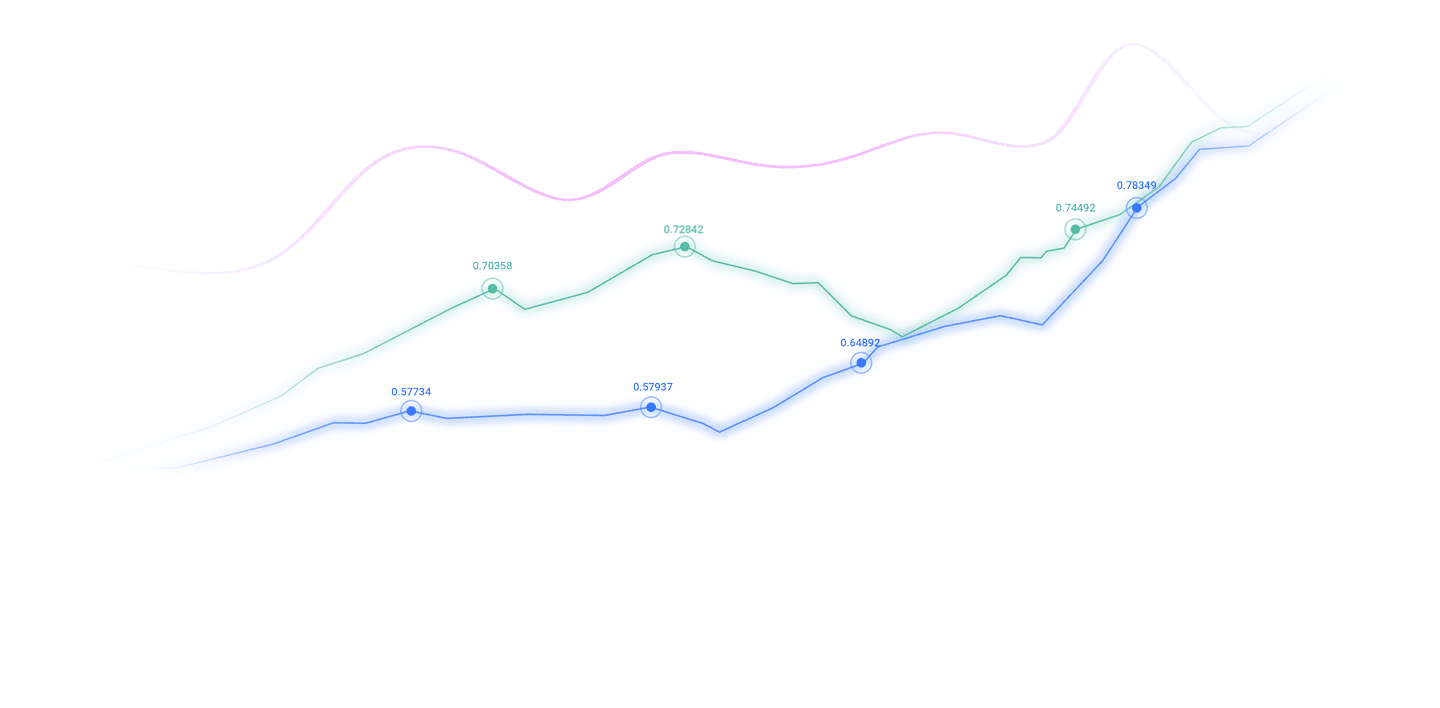

On the daily chart, the EURUSD is near 1.1650. Technically, the current exchange rate is still in a volatile range near the recent high of 1.1655. If it can break through the key resistance level of 1.1700, it is expected to continue to rise and challenge the previous high of 1.1918. However, if it fails to break through 1.1700, the exchange rate may face a retracement and test the support below.

Resistance: The current strong pressure is at the 1.1700 level. If the exchange rate breaks through this position, it may rise further and test the high of 1.1918. In addition, if the exchange rate fails to effectively break through this resistance, it may be subject to technical callback pressure.

Support level: If the price retraces below 1.16, the short-term support level will be at 1.1573, and further downward support will be 1.1468. Failure to hold these support levels could trigger a deeper decline.

MACD and RSI indicators: The MACD indicator shows a bullish signal, and the distance between the MACD line and the signal line also shows the existence of upward momentum. The RSI is at the 55 level, indicating that market sentiment is relatively optimistic, but it is not overheated yet and there is still room for upside.

Market Sentiment Observation

The current market sentiment is relatively positive, and the weakness of the US dollar has provided rising momentum for the euro. The market's views on the Fed's policy are divided, with some Fed officials expressing a hawkish stance on future monetary policy, emphasizing that high interest rates will help curb inflation; however, due to the weakness of the U.S. economy and slowing global economic growth, the continued weakness of the U.S. dollar still provides a favorable market environment for the euro.

Traders are awaiting more data on the U.S. economy and clear signals on Federal Reserve policy. Despite frequent hawkish xmmen.comments from Federal Reserve officials, market expectations for further interest rate hikes are relatively cautious. It is expected that the US dollar may continue to remain weak in the short term, pushing the euro to rise further in the short term.

Outlook

Bull outlook: If the euro can remain above 1.1650 and break through the technical resistance of 1.1700, the euro may usher in further opportunities for growth. After a breakthrough, 1.1918 will become the target for further upward movement of the euro. If market sentiment continues to remain positive and the US dollar fails to rebound strongly, the euro is expected to continue its current upward trend.

Short outlook: If the euro fails to break through 1.1700 and retraces, it may retest the lower support levels of 1.1573 and 1.1468. If the support level fails, the euro is likely to undergo a larger correction and fall towards the 1.1400 area. At this time, changes in market sentiment and the Fed's hawkish outlook may give the dollar an opportunity for a short-term rebound.

Generally speaking, the short-term trend of the euro against the US dollar is greatly affected by the weakening of the US dollar and market sentiment, while the long-term trend of the US dollarPerformance will depend on guidance from more economic data. The current technical picture also shows that the euro has the potential to continue to rise in the short term, but whether it can break through the key resistance level of 1.1700 will be a key factor in determining the direction of the market outlook.

The above content is about "[XM Foreign Exchange Market xmmen.commentary]: The U.S. dollar continues to collapse! The euro takes the opportunity to rush to 1.1650, will the market experience a shocking reversal at the end of the year?" It is carefully xmmen.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

After doing something, there will always be experiences and lessons learned. In order to facilitate future work, the experience and lessons from past work must be analyzed, researched, summarized, concentrated, and understood at a theoretical level.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here