Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Five major events to happen in the global market this week

- Soft crude oil and tariffs suppress the Canadian dollar, the dollar rebounded ab

- Bank of England hawkish interest rate cuts boost pound, U.S. inflation risk is n

- 8.7 Gold was perfectly taken by all yesterday, and the 80-stop area was first in

- Practical foreign exchange strategy on July 25

market analysis

Gold prices approach 4,000 mark, Fed rate cut expectations heat up, political uncertainty in the United States, France and Japan boosts

Wonderful introduction:

Optimism is the line of egrets that go straight up to the sky, optimism is the thousands of white sails on the side of the sunken boat, optimism is the luxuriant grass blowing in the wind at the head of Parrot Island, optimism is the little bits of falling red that turn into spring mud to protect the flowers.

Hello everyone, today XM Forex will bring you "[XM official website]: Gold price approaches the 4,000 mark, expectations for an interest rate cut by the Federal Reserve rise, boosted by political uncertainty in the United States, France and Japan." Hope this helps you! The original content is as follows:

Basic News

On Tuesday (October 7, Beijing time), spot gold was trading around US$3,971 per ounce. On Monday, the price of gold hit a new all-time high of US$3,976.06 per ounce, as expectations for an interest rate cut by the Federal Reserve this month increased. As well as boosted by economic and political uncertainty in the United States, France and Japan; U.S. crude oil traded around $61.73 per barrel. Oil prices rose on Monday after OPEC+ planned to increase production by a smaller margin than expected in November, easing some concerns about increased supply, although a weak demand outlook may limit recent gains.

Stock Market

The S&P 500 and the Nasdaq rose on Monday, as artificial intelligence-related transactions boosted investor sentiment. Although the U.S. government shutdown entered its sixth day, the Nasdaq and the S&P 500 both hit new closing highs, while the Dow Jones Industrial Average fell slightly.

The chip sector led the gains after chipmaker AMD said it would supply AI chips to OpenAI. The deal could bring tens of billions of dollars in annual revenue and allow OpenAI to acquire up to 10% of the xmmen.company's shares. AMD shares surged 23.7%, and the Philadelphia Semiconductor Index rose 2.9%.

Robert Pavlik, senior portfolio manager at DakotaWealth in Fairfield, Connecticut, said that the market has shown some strength in areas such as technology and consumer discretionary goods. In contrast to the government shutdown, the market still maintains interest in AI transactions and related xmmen.companies.

Pavlik added: “This is a wave, and waves don’t last forever; they will eventually peak and fall back. But we are now inAt what stage of this wave? This cannot be judged. ”

The federal government has been shut down for the sixth consecutive day due to the party deadlock, and the release of key economic data has been postponed, forcing investors to rely on secondary and unofficial data to determine the timing and extent of the Fed's rate cut.

Although some monetary policy makers warn that inflation is still high and there should be no rush to lower the federal funds target rate, some believe that the labor market has shown signs of weakness and support rate cuts.

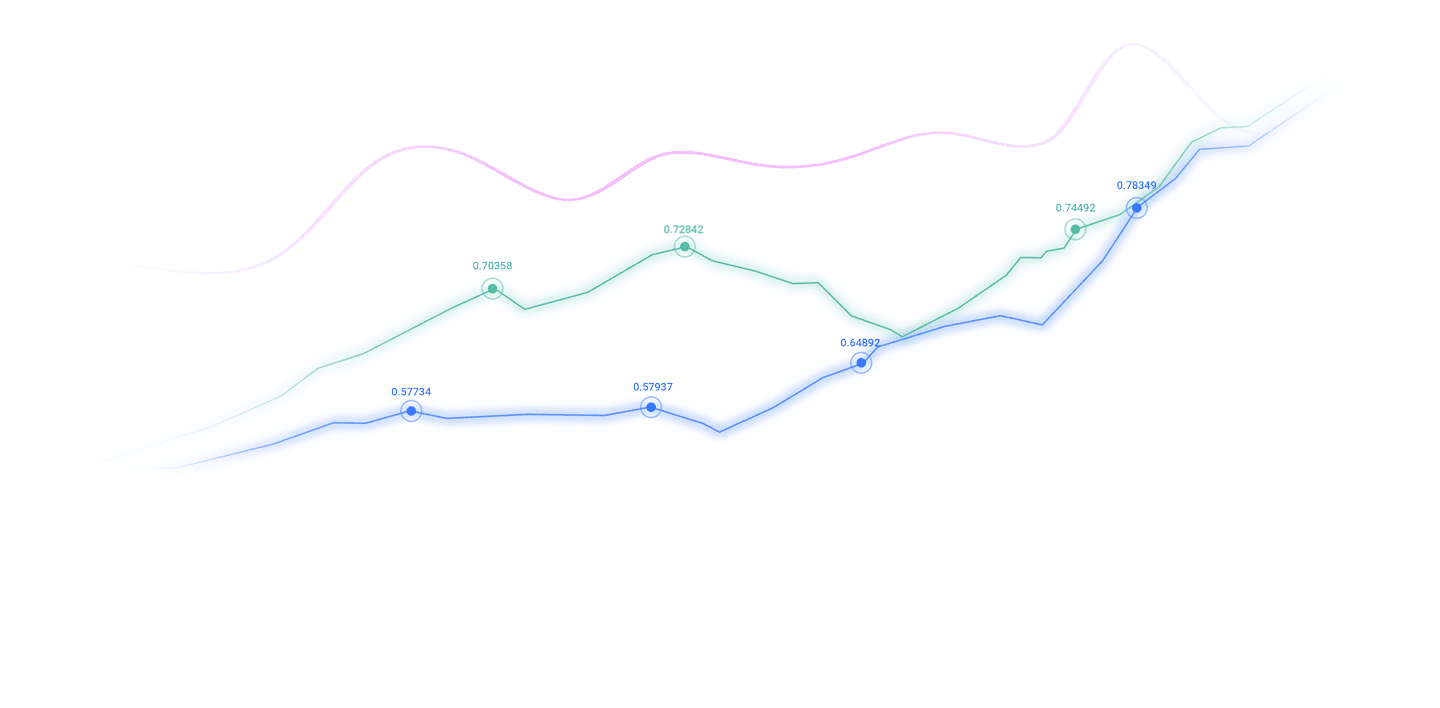

The financial market has almost xmmen.completely digested the Fed's expectation of a 25 basis point cut at the end of its October meeting, with a probability of 94.6%.

New U.S. government data is lacking this week, and market participants will focus on consumer credit balances, mortgage demand and the initial stages of the University of Michigan's consumer confidence in October

Dow Jones Industrial Average fell 0.14% to 46,694.97 points; the S&P 500 rose 0.36% to 6,740.28 points; the Nasdaq rose 0.71% to 22,941.67 points.

The consumer discretionary sector led the rise, and the real estate sector fell the most. Next week, third-quarter results will be the market catalyst, with major U.S. banks reporting financial reports.

According to data from London Stock Exchange Group (LSEG), analysts expect S&P 500 xmmen.components to grow 8.8% year-on-year in the third quarter, 0.8 percentage points higher than forecasts at the beginning of the third quarter.

Tesla rose 5.5% after the electric vehicle maker predicted an event on social platform X on Tuesday. TDCowen lowered Starbucks=’s target price, citing weak labor market impacts Gen Z, with Starbucks stock price falling 5.0%.

Gold market

Gold surged to an all-time high of more than $3,900 an ounce on Monday, boosted by rising expectations of a rate cut by the Federal Reserve this month and economic and political uncertainty in the U.S., France and Japan.

Spot gold hit a high of $3,976.06 during the session on Monday. U.S. gold futures for December delivery closed up 1.7% to $3,976.3 an ounce.

Marex analyst Edwa rdMeir said the development of France's political situation, rising Japanese government yields under inflation concerns and continued shutdowns are the reasons for gold's surge.

The new French Prime Minister Sebastien Lecornu and his government resigned on Monday hours after taking office, deepening the country's political crisis.

At the same time, the U.S. government shutdown has entered its sixth day, and the White House threatens to cut federal staff on a large scale.

Backed by the Fed's interest rate cut, the central bank's continued purchases, constant demand for safe-haven demand and widespread weakening of the U.S. dollar, gold has climbed 50% so far this year, setting a record high. Spot gold prices broke through $3,000 per ounce for the first time in March and exceeded 38 by the end of September.$00/oz. In times of low interest rate environment and economic instability, non-interest gold is popular.

Investors are currently pricing that the Fed will cut interest rates by 25 basis points at this month's meeting and is expected to cut interest rates by another 25 basis points in December.

UBS said in a report that we believe gold has reason to rebound further due to fundamentals and momentum, and now it is expected that gold prices will reach $4,200 per ounce by the end of this year.

Spot silver climbed 1.4% to $48.66 per ounce, the highest level in more than 14 years. Platinum rose 1.4% to $1,626.75; palladium rose 4.3% to $1,315.17. Oil markets

Oil prices rose more than 1% on Monday after OPEC+ planned to increase production in November smaller than expected, eased some concerns about increased supply, but weak demand outlook could limit recent gains.

Brent crude oil futures closed up 1.46% to $65.47 a barrel; U.S. crude oil was $61.69, up 1.33%.

LipowOil Associates president Andrew Lipow said the market believes that given that some of the OPEC+ member countries are already producing at full capacity, the actual amount of oil entering the market will be far less than they announced.

OPEC+ said on Sunday it would increase oil production by 137,000 barrels per day from November, choosing a rather modest monthly increase as October, as concerns about oversupply continued to exist in the market. Before the meeting, sources said that although Russia advocated a 137,000 barrels per day increase to avoid pressure on prices, Saudi Arabia would rather double, triple or even quadruple the output to quickly regain market share.

In the short term, some analysts expect the upcoming refinery overhaul season in the Middle East to help curb oil prices. Expectations of weak fundamentals in the fourth quarter are another factor limiting the market's upward trend.

The U.S. Energy Information Administration (EIA) said last week that U.S. crude, gasoline and distillate stocks increased more than expected in the week ended September 26 due to weak refining activity and demand.

Foreign market

The yen and euro weakened against the dollar on Monday as Japan's ruling Liberal Democratic Party elected a new leader and the resignation of a new French government sparked concerns about fiscal and political stability.

The ruling Japanese party elected conservative Saeon Takashi as the party leader last Saturday, pushing the yen to fall. Takashi Saemi is an advocate of the late Prime Minister Shinzo Abe's "Abenomics" strategy, which aims to stimulate the economy through active spending and loose monetary policy. Her victory has led traders to reduce bets on the Bank of Japan's interest rate hike this month.

Sarah Ying, head of foreign exchange strategy, fixed income and xmmen.commodity strategy for Imperial Canadian xmmen.commercial Bank in Toronto, said: "It is surprising that Takashi Saemi will become Prime Minister.Given that Takashi Saemi is often seen as a follower of Abenomics, there is now more focus on long-term government bonds. The market expects Japan to introduce more fiscal stimulus measures. ”

The dollar rose more than 2% against the yen at one point to 150.47 yen, the highest since August 1. The latest up 1.87% to 150.2, which would be the biggest single-day gain since May 12 if the momentum continues.

The Bank of Japan maintained a cautiously optimistic economic forecast on Monday, but warned that there is still uncertainty about the impact of U.S. tariffs on corporate profits, indicating its tendency to wait for more data before hikes.

The euro reached 176.25 yen intraday, the highest level since the establishment of the euro in 1999.

However, the euro fell against the dollar and pound, after the new French Prime Minister Le Cornie (Sebastien Lecornu) and his government resigned a few hours after announcing the cabinet list on Monday, becoming the shortest-term government in modern French history.

Ying said that this is not a survival crisis, but considering the current budget situation, the domestic situation does not look good. The biggest risk is that Macron (the president) resigns, but the possibility of such a situation is not high.

The euro fell 0.26% against the dollar to $1.171. It had previously hit $1.1649, the lowest level since September 25. The euro and pound also fell to their lowest level since September 18.

Euro-USD senior officials said on Monday that if the The risk of too low swelling increases, and the ECB may need to slightly reduce borrowing costs, but current interest rates are appropriate. The U.S. dollar index rose 0.4% to 98.11.

Traders are waiting for signs of a reopening of the U.S. federal government, which has so far failed to pass a bill to continue to allocate funds for government operations.

The government shutdown has delayed the release of the monthly jobs report in September last Friday and other important data after the government reopens. This has also led to a decrease in market volatility.

Themistoklis Fiotakis-led Barclays analysts said in a report that financial market volatility has dropped sharply since the U.S. government shutdown. The risks to U.S. economic activity and labor market posed by federal staff without pay leave or even being fired will not appear for some time.

As data show that the labor market is weak, the market generally expects the Federal Reserve to cut interest rates by 25 basis points at its meeting on October 28-29.

According to CME’s FedWatch tool, traders expect another rate cut in December is 83%, but this may depend on the data released before the meeting.

International News

Hamas delegation: positive progress has been made indirect negotiations with Israel

On October 7, local time, representatives of the Islamic Resistance Movement (Hamas)After ending indirect negotiations with Israel, the mission said that the talks had made positive progress, but the Israeli continued bombing of the Gaza Strip "posed a challenge" to the release of Israel's detained personnel.

The resigned French Prime Minister was ordered to start "final negotiations" with various political parties

The resigned French Prime Minister Le Cornie posted on social media on the evening of the 6th that he was ordered by President Macron to conduct a two-day "final negotiations" with various political parties in order to maintain national stability. Le Kearney said he will report the negotiation results to Macron on the evening of the 8th local time, and the latter will make necessary decisions based on this.

The Argentine government intervened in the market for five consecutive days and sold at least US$1.3 billion to support the peso

People familiar with the matter revealed that the Argentine government sold US dollars in the foreign exchange market on Monday. This is the fifth consecutive trading day of the country's government's intervention in an attempt to stop the peso depreciation. The central bank of Argentina sold $450 million to $480 million at a price of 1,430 pesos per dollar. The Argentine government sold an estimated $850 million to support the peso last Tuesday to Friday, after the Milei government spent $1.1 billion to support the peso before U.S. Treasury Secretary Bescent last month to provide financial aid and calm the market.

Bank of England Governor urges an open look at the opportunities and risks of artificial intelligence

Bank of England Governor Andrew Bailey said in a speech scheduled to be delivered in Scotland late Monday that the UK should create an environment conducive to investment. Bailey will point out at the Global Investment Summit in Edinburgh that economies need to make breakthroughs in the so-called "universal technology" (GPT) sector to drive investment and productivity gains. Artificial intelligence (AI) is an example. “We have to look at the potential and risks of AI with a pragmatic and open attitude,” Bailey said, adding that he is optimistic about “opportunities for investment, innovation and growth.”

Lulla and Trump called on the United States to revoke the 40% tariff imposed on Brazil

The Brazilian government issued an announcement on October 6 local time stating that Brazilian President Lula and US President Trump held a conference call on the same day. During the talks, Lula asked the United States to cancel the 40% tariffs imposed on Brazilian products, and Trump appointed Secretary of State Rubio to continue negotiations with Brazilian Vice President Alkine. The Brazilian government also said that Lula and Trump agreed to hold a face-to-face meeting as soon as possible, which may be in Malaysia. The two sides exchanged phone numbers to maintain direct xmmen.communication.

Japan Liberal Democratic Party President Takashi Saemi basically finalized the four important positions within the party

Related people revealed that Japan's Liberal Democratic Party President Takashi Saemi basically finalized the four important positions within the party on the 6th. The former economic security responsibility minister Kobayashi Takayuki served as the president of the government affairs investigation, Senator Orimura served as the president of the general affairs, and former National Public Security Chairman Keiji Koya served as the chairman of the election countermeasures. Former Prime Minister Taro Aso will be appointed as vice president, allowing former Abe faction former political republication president Koichi Hagida, who is involved in the faction's kickbacks incident, to serve as agentChief Secretary. If Takaichi becomes Prime Minister, the plan is to have former Secretary-General Motegi Toshimitsu as Foreign Minister, and former Defense Minister Minoru Kihara of the Motegi faction as Chief Cabinet Secretary. The Liberal Democratic Party will hold an extraordinary general meeting on the 7th to decide on senior party personnel. Afterwards, the four major party officials will attend a press conference.

Sources: Bessent will continue to serve as director of the IRS, and a new CEO position will be created

Sources said that U.S. Treasury Secretary Bessant will continue to serve as director of the IRS and will announce a new official to serve as his top deputy. Bessant took over the IRS in August after Trump fired Billy Long just two months after he was confirmed. No Treasury secretary has led the IRS before, raising questions about the politicization of the agency. While the situation is supposed to be temporary, Trump has decided he wants Bessant to retain control of the organization, people familiar with the matter said. While Bessant will continue to serve as xmmen.commissioner, he is expected to announce Frank Bisignano, who currently serves as xmmen.commissioner of the Social Security Administration, to the newly created position of CEO of the IRS. Both Bessant and Frank Bisignano are expected to serve in dual roles in the government indefinitely.

Domestic News

U.S. investors increased their investment in Chinese technology stocks before the "Golden Week", and CQQQ's gold-absorbing amount hit a new single-day high

Invesco China Technology ETF (code CQQQ) once again led the U.S. exchange-traded funds investing in the country in gold-absorbing last week, with Monday's inflow setting another single-day record. The fund attracted $292 million last week, recording its sixth straight week of inflows and its longest streak since late March, data xmmen.compiled by Bloomberg showed.

The above content is all about "[XM official website]: Gold price approaches the 4,000 mark, expectations for a rate cut by the Federal Reserve rise, and political uncertainty boosts the United States, France and Japan". It is carefully xmmen.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Sharing is as simple as a gust of wind can bring refreshing, as pure as a flower can bring fragrance. Gradually my dusty heart opened up, and I understood that sharing is actually as simple as the technology.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here