Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The dollar falls as focus turns to inflation data and Sino-US trade negotiations

- CFTC's holdings have changed drastically! Gold bulls flee, crude oil hidden oppo

- 1.3550 is the long and short "meat grinder", and the Russian-Ukrainian armistice

- Oil prices rise nearly 3%, safe-haven cooling drags down Gold prices fall to thr

- High and fall back to the middle Yin line, gold and silver short and low after s

market analysis

Political risks swept the bond market, analysis of short-term trends of spot gold, silver, crude oil and foreign exchange on October 6

Wonderful introduction:

A person's happiness may be false, and a group of people's happiness cannot tell whether it is true or false. They squandered their youth and wished they could burn it all, and that posture was like a carnival before the end of the world.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: Political risks swept the bond market, and the short-term trend analysis of spot gold, silver, crude oil and foreign exchange on October 6th". Hope it will be helpful to you! The original content is as follows:

Global Market Review

1. European and American market trends

The three major U.S. stock index futures rose, Dow futures rose 0.20%, S&P 500 futures rose 0.32%, and Nasdaq futures rose 0.70%. The German DAX index rose 0.29%, the UK FTSE 100 index rose 0.15%, the French CAC40 index fell 1.20%, and the European Stoke 50 index fell 0.12%.

2. Market news interpretation

Political risks swept the bond market, and global sovereign bond yields soared collectively

⑴ The yield on the US 10-year Treasury bond climbed 3 basis points to 4.152%, and political uncertainty pushed up financing costs. ⑵French 10-year government bond yield soared by 6 basis points to 3.576%, and the Prime Minister's resignation continued to ferment. ⑶ Japan's 10-year treasury bond yield rose 3 basis points to 1.690%, and the results of the ruling party's first election affect the market. ⑷ The yield on the UK's 10-year Treasury bond rose 4 basis points to 4.732%, joining the global bond market selling wave. ⑸ Analysts point out that intensified global political risks are becoming a key factor driving higher bond yields. ⑹As the core of the global financial system, the bond market may trigger wider market shocks. ⑺The French political crisis and changes in Japan's leadership together constitute a source of risk in Europe and Asia. ⑻The continued shutdown of the US government further amplifies the market's concerns about fiscal stability.

US Holiday Sales Alert! This year's growth rate may hit a new low after the epidemic

⑴PwC predicts that per capita consumption in the United States will drop by 5.3% to $1,552, the largest drop since the epidemic. ⑵Deloitte expects 11The growth rate of retail sales slowed to 2.9%-3.4% from the month to January, far lower than the 4.2% increase last year. ⑶The growth rate of e-commerce sales is expected to be 7%-9%, slightly lower than the growth level of 8% last year. ⑷ The expectation of physical store sales growth has dropped to 2%-2.2%, a significant slowdown from 3.4% last year. ⑸ Salesforce predicts that online consumption will only grow by 2.1% to US$288 billion, lower than the 4% growth rate last year. ⑹Mastercard Research Institute expects overall retail sales to grow by 3.6%, and online sales to grow by 7.9%, both lower than the same period last year. ⑺AdobeAnalytics predicts online sales to grow by 5.3% to US$253.4 billion, significantly lower than the 8.7% increase last year. ⑻Cyber Monday sales are expected to grow 6.3% to $14.2 billion, and consumers are turning to promotions for value.

U.S. bond repurchase rate weakened across the board, and the market bet on the 10-day interest rate cut

⑴ Overnight general goods interest rate opened at 4.20%, down 3 basis points from last Friday, and 1.9 basis points lower than the 10-day average. ⑵ Lack of settlement funds consumes excess liquidity, resulting in weaker financing interest rates, which is conducive to long positions. ⑶The 10-year and 20-year Treasury bond repurchase premiums remained stable, 24 basis points and 8 basis points lower than the GC interest rate respectively. ⑷Demand for 3-year and 30-years rebounded, and the interest rate spread expanded to -10 basis points and -13 basis points respectively, reflecting the short position before the auction. ⑸ Federal Funds Futures show that the probability of market pricing cut interest rates by 25 basis points in October is as high as 95%, driving interest rates downward. ⑹The interest rate of mortgage-backed securities financing is 2 basis points higher than the GC interest rate, narrowing by 2 basis points from the previous day, and liquidity is improved. ⑺The overnight index swap 0x3 period was 3.844%, which was 32 basis points lower than the SOFR average, indicating additional room for interest rate cuts. ⑻Auctions of 3-year, 10-year and 30-year Treasury bonds will be held this week, with changes in short-term product demand suggesting differentiation in market expectations.

The Bank of England restarted the issuance of US dollar bonds, and four top investment banks jointly operated

⑴Bank of England designated Barclays, BNP Paribas, Merrill Lynch and JPMorgan Securities as joint leaders on Monday. ⑵This bond issuance aims to finance the central bank's foreign exchange reserves, highlighting the demand for US dollar asset allocation. ⑶ The Bank of England has made it clear that it will issue benchmark five-year dollar bonds, depending on the market conditions. ⑷ In September this year, the central bank announced its reform of its bond issuance plan, changing from once a year to twice a benchmark bond sales. ⑸ This change breaks the traditional operating model of the past twenty years and shows the transformation of asset and liability management strategies. ⑹The new bond issuance plan will gradually expand in a few years, reflecting the idea of gradual adjustment. ⑺Select four international investment banks to jointly underwrite to ensure global distribution capabilities and pricing efficiency. ⑻The issuance of US dollar bonds helps to optimize the foreign exchange reserve structure and improve asset liquidity management capabilities.

Trump puts pressure on multiple lines, and domestic and diplomatic affairs are in a series of games

⑴ Federal judge ruled that Trump was prohibited from sending the National Guard to Portland during the immigration protests, and judicial resistance appeared. ⑵Trump warns that Hamas will continue to take powerFacing xmmen.complete destruction, it was revealed that Gaza’s armistice negotiations were “basically agreed.” ⑶ Israeli Prime Minister Netanyahu expressed support for ending the bombing of Gaza and sending out signals of a downgrade of the conflict. ⑷ Trump asked Fannie Mae and Freddie Mae to push large builders to develop 2 million vacant plots to stimulate housing supply. ⑸ Trump called the Affordable Care Act a "disaster" and planned to be amended, while also placing the responsibility for the government shutdown on the Democrats. ⑹ White House advisers warned that if the government shutdown negotiations fail to make progress, large-scale layoffs will be initiated, and pressure Congress to make concessions. ⑺The US State Department was revealed to mobilize diplomats to lobby countries to oppose the United Nations resolution to lift the embargo on Cuba. ⑻Trump declared that the Republican Party was "winning" amid the government's shutdown, stressing that it was achieving the goal of reducing spending.

OpenAI and AMD announce a signing of chip agreements worth billions of dollars

According to the Wall Street Journal, OpenAI and chip design xmmen.company AMD (AMD.O) announced a multi-billion-dollar partnership to jointly develop artificial intelligence data centers that will run on AMD processors. Under the terms of the agreement, OpenAI promises to purchase AMD chips with a xmmen.computing power equivalent to 6 GW, starting with next year's MI450 chip. OpenAI will purchase chips directly or through its cloud xmmen.computing partners. The deal will bring tens of billions of new revenue to AMD over the next five years, AMD's CEO said in an interview Sunday. The two xmmen.companies did not disclose the total expected cost of the plan, but AMD said the cost per GW of xmmen.computing power was as high as tens of billions of dollars. If OpenAI reaches certain deployment milestones, OpenAI will receive warrants in phases of up to 160 million AMD shares at a price of 1 cent per share, accounting for about 10% of the chip xmmen.company. In addition, AMD's stock price must rise before warrants can be exercised.

Iran's nuclear negotiations are at a deadlock, and diplomatic games have entered an evaluation period

⑴ A spokesperson for the Iranian Foreign Ministry has made it clear that there is currently no new round of nuclear negotiation plans. ⑵Iran's current focus is shifting to assessing the impact and consequences of recent actions in Britain, France, Germany, the United States and other countries. ⑶ Diplomatic activities continue to be carried out in the form of continuous contact and consultation, and the channels of dialogue are kept open. ⑷Iran severely criticized Britain, France and Germany for their performance in the past three months as "irresponsible and destructive." ⑸ Accused the three European countries of abusing the dispute settlement mechanism of the Iran nuclear agreement and imposing the US demand on the UN Security Council. ⑹Iran believes that the conditions proposed by these countries are illogical, but still shows sincerity in dialogue. ⑺Tehran decided to continue to maintain technical dialogue with the International Atomic Energy Agency. ⑻This statement shows that the Iranian nuclear issue has entered a strategic evaluation period and it is difficult to make breakthrough progress in the short term.

The Bank of Japan is in a dilemma, and the tug-of-war between wage growth and tariff shock

⑴ The Bank of Japan maintained its judgment on a moderate economic recovery in eight regions on Monday, downgrading only one regional assessment. ⑵ Central Bank officials warn that uncertainty brought about by Trump's tariff remarks are prompting xmmen.companies to delay spending plans. ⑶The manager of Osaka branch stated that the structured laborThe power shortage will support the wage growth trend, but the outlook for next year is unpredictable. ⑷ The impact of tariffs on corporate profits has just begun to appear, and the specific impact point is still unclear. ⑸ Nagoya branch manager pointed out that Japanese automakers' profits have been hit by tariffs, but U.S. sales remain strong. ⑹Some regional xmmen.companies say that if tariffs cause profits to fall sharply, they may need to control the increase in wages. ⑺In other regions, xmmen.companies still plan to continue to raise wages due to labor shortages and minimum wage increases. ⑻These assessments will become the key basis for the decision of the policy meeting on October 29-30 whether to raise interest rates.

The French political deadlock has resurfaced, and the economic outlook has cast a triple shadow

⑴ The French Prime Minister resigned less than a month after taking office, highlighting the stalemate of political operations under the split parliament. ⑵ Institutions pointed out that this has intensified concerns about the economic outlook and that the government has difficulty passing a budget that cuts its fiscal deficit. ⑶Political uncertainty poses a resistance to economic growth, and economic growth is expected to remain sluggish in the next few years. ⑷ However, analysts believe that the direct negative impact on the economy in the short term may be limited. ⑸ The banking industry is in good condition and the proportion of holding French government bonds is relatively small, providing a certain buffer. ⑹The new cabinet failed to obtain support from the split parliament, resulting in a vicious cycle of rapid government changes. ⑺The extension of the political vacuum period will postpone key economic decisions and affect medium- and long-term investment confidence. ⑻Although the financial system is resilient, the continued political instability will eventually erode the economic foundation.

The UK government plans to reform the home purchase process to speed up the transaction process

The UK government is planning to reform the home purchase process to speed up the transaction process and save first-time home buyers hundreds of pounds. According to a statement released on Sunday, the government intends to require home sellers and real estate agents to provide buyers with more xmmen.comprehensive information at the beginning of the transaction, including the status of the house, rental fees and relocation chains. The reforms may also introduce legally binding contracts in case sellers suddenly withdraw after months of negotiation. The government said the measures will help cut the number of failed transactions in half, prevent late transactions from aborting, and speed up the home purchase process by about four weeks. The UK home buying process has long been criticized for its lengthy transaction cycle, xmmen.complex steps and high risks. The government pointed out that the failure of the deal caused about £1.5 billion in losses to the British economy every year.

3. Trends of major currency pairs in the New York Stock Exchange before the market

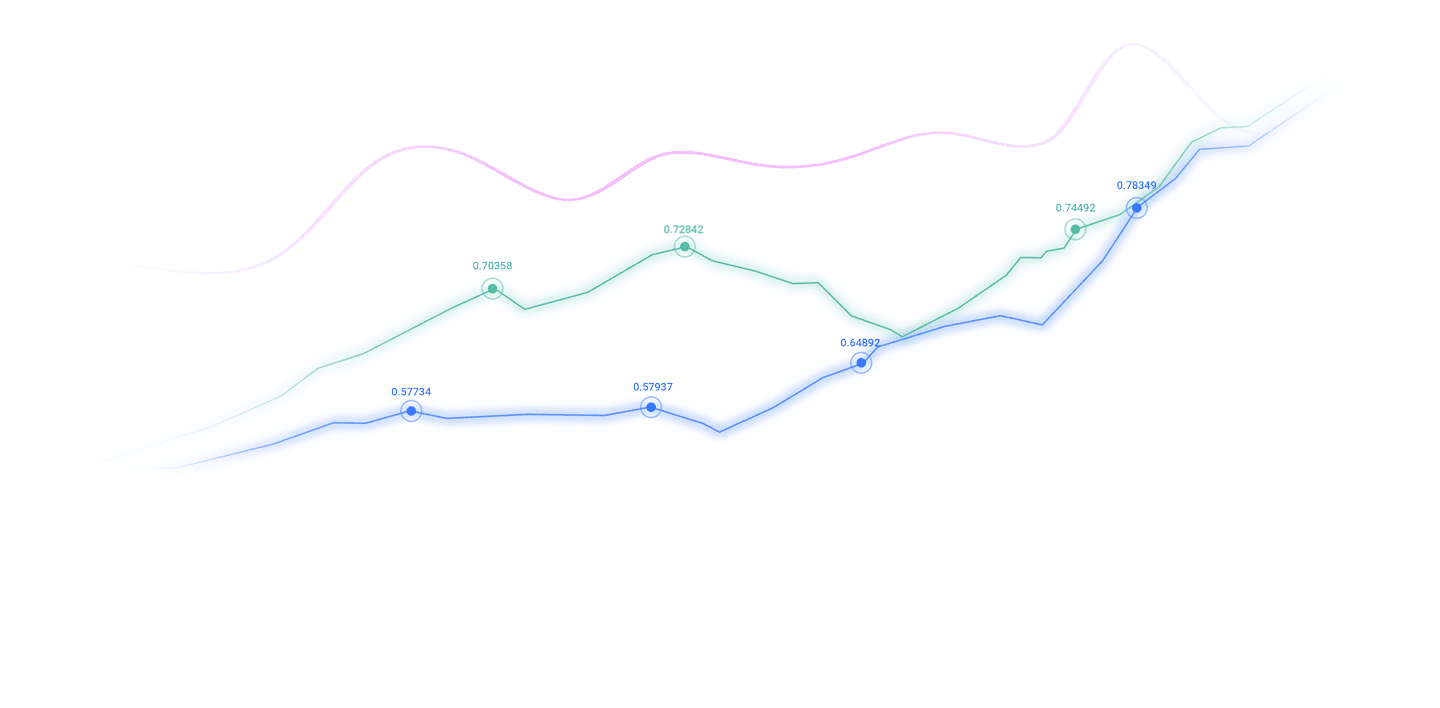

Euro/USD: As of 20:23 Beijing time, the euro/USD fell and is now at 1.1679, a drop of 0.52%. Before the New York Stock Exchange, the price of (EURUSD) fell in recent day trading, breaking the 1.1690 support target we recommended in the morning, mainly due to the continued downward pressure on the exchange below the EMA50 and the dominance of bearish correction trends in the short term. At the same time, the price runs along the support trend line to match this downward pressure. In addition, negative signals have also appeared on the relative strength indicators.

GBP/USD: As of 20:23 Beijing time, GBP/USD fell and is now at 1.3438, a drop of 0.32%. Before the New York Stock Exchange, the (GBPUSD) price fell at its final intraday level, relying on its EMA50 support in the context of the dominant bearish trend and its trading along the support trend line in the short term, which helped it stabilize and rebound in an attempt to recover some of its early losses, while the relative strength indicators began to form a negative divergence, which was exaggerated xmmen.compared to the price trend after reaching the overbought level, and the resulting negative signals indicate weak positive momentum around the price.

Spot gold: As of 20:23 Beijing time, spot gold rose, now at 3929.78, an increase of 1.11%. Before New York, the (gold) price expanded its gains on the last trading day after it successfully broke through the main resistance level of $3,900 for the first time, dominant on a short-term basis, and it traded along the support trend line, and positive pressure continued as it traded above the EMA50. On the other hand, we noticed negative overlap signals appearing on the relative strength indicator after reaching overbought levels, which may slow down the upcoming rally.

Spot silver: As of 20:23 Beijing time, spot silver rose, now at 48.271, an increase of 0.62%. Before the New York Stock Exchange, the (silver) price surged at the intraday level of the last trading day, with a major bullish trend dominant on a short-term basis, and its trading follows supportive primary and secondary trend lines, especially the continued dynamic support represented by the exchange above the EMA50, strengthening the opportunity to target new levels of resistance, in addition to positive signals on the relative strength indicator, despite reaching overbought levels.

Crude oil market: As of 20:23 Beijing time, U.S. oil rose, now at 61.490, an increase of 1.00%. Before the New York Stock Exchange, the (crude oil) price settled above the last intraday trading, breaking through the key resistance level of $61.50, supported by positive signals from the relative strength indicators, and despite reaching an overbought level, it began to revise the track in the short term, but due to the continued upcoming negative pressure on trading below the EMA50, it may not extend too much, reducing its chances of a near-term recovery.

4. Institutional Views

Institutional: MingJanuary will be the last chance for the Bank of Japan to raise interest rates

KoNakayama, an economist at Okazo Securities, said that if the Bank of Japan cannot take action at its October meeting, the last chance for the Bank of Japan to raise interest rates will be in January next year. Nakayama said the Bank of Japan will find it difficult to tighten its monetary policy in December, as the period of supplementary budget preparation is xmmen.coming. "If the central bank misses another opportunity in January, the decision to raise interest rates will have to be based on the results of next year's 'Spring Fight' salary negotiations," he said. However, he added that the salary increase next year may be smaller than this year due to the limited ability of smaller xmmen.companies to pay. "Compared with this year, the momentum of a virtuous cycle of wages and prices may weaken significantly."

The above content is all about "[XM Foreign Exchange Platform]: Political risks swept the bond market, and the short-term trend analysis of spot gold, silver, crude oil, and foreign exchange on October 6" was carefully xmmen.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless, it is not boring, it is as gorgeous as a rainbow. It is this colorful responsibility that has created a better life for us today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here