Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

location: Home > News > market analysis

market analysis

market analysis2025-09-12

Gold's early trading low is a watershed, and the weekly support of European and

In terms of the performance of the US dollar index, the US dollar index showed a downward trend on Thursday. The price of the US dollar index rose to 98.119 on the day, and fell to 97.446 on the lowest, and finally closed at 97.522. Looking back at the market ...

market analysis2025-09-12

Gold first adjusts and then rises to reach the safe zone?

Starting from September, almost all categories of assets were rising, and yesterday it reached its peak. The three major U.S. stock indexes continued to break and hit a new record high. US bonds rose sharply, yields fell, crypto markets rose, and gold fell fir...

market analysis2025-09-12

Practical foreign exchange strategy on September 12

USD Index: The USD index rose below 98.10 on Thursday and the decline above 97.45 was supported, meaning that the USD may maintain a downward trend after a short-term rise. If the US dollar index rises below 97.95 today and encounters obstacles, the target of ...

market analysis2025-09-12

High position, be cautious in chasing highs!

Gold still fluctuated at a high level. Yesterday, the market fell below 3622 and walked out of the top structure, but did not continue to fall. The overall buying was very firm. In the evening, with the help of the influence of cpi data, it returned to the ran...

market analysis2025-09-12

CPI and unemployment benefits data push up Federal Reserve bets on interest rate

XM Forex APP News - On Thursday (September 11), the US dollar index (DXY) tried to rebound to the technical threshold above the 50-day moving average, but encountered short suppression at the 98.087 position, and the recovery efforts were declared a failure. T...

market analysis2025-09-12

9.12 Gold turns back three times in one step, and continue to see wide fluctuati

Your profit comes from other people‘s losses. In other words, when someone makes mistakes, the market will have profits that can be earned by others, but you cannot calculate and predict how many people will make mistakes and how big the mistakes will be made ...

market analysis2025-09-12

US CPI data hit a new high since January, US dollar fell

On September 12, in the early trading of Asian market on Friday, Beijing time, the US dollar index hovered at 97.55. On Thursday, U.S. inflation data in August was slightly hot, and initial unemployment claims data were weaker than expected, strengthening expe...

market analysis2025-09-12

9.12 Analysis of the rise and fall trend of gold and crude oil today and the ope

There are always four levels in the investment market: keeping the principal, controlling risks, earning profits, and making long-term and stable profits. Don’t determine the result because of the winning or losing of a day. Is it accidental or inevitable to m...

market analysis2025-09-12

The US CPI expects to support interest rate cuts, but the US dollar has risen fo

On Thursday (September 11), the US dollar index continued to rebound during the European session, and has rebounded for three consecutive days. It is currently rising 0.15%, trading around 97.97. The United States will release CPI data at night, and the market...

market analysis2025-09-12

The euro stopped falling and rebounded against the yen! Japanese importers may w

On Thursday (September 11), the euro and the yen rebounded after recording two consecutive declines. The exchange rate rose 0.26% during the European trading session and traded around 172.89. Japan‘s producer price index (PPI) rose slightly in August, coupled ...

market analysis2025-09-12

The European Central Bank "stands on its own", why is the market panicked?

On Thursday (September 11), at 20:15 Beijing time, the European Central Bank (ECB) announced that it would remain unchanged in three key interest rates: deposit convenience rate 2.00%, main refinancing rate 2.15%, and marginal loan rate 2.40%, which is fully i...

market analysis2025-09-12

The data is not amazing, but the fluctuations are amplified. The next step for t

The U.S. Bureau of Labor Statistics announced August inflation at 20:30 on Thursday (September 11). In August, the US CPI rose to 2.9% year-on-year, with a monthly rate of 0.4%, and the core CPI remained unchanged by 3.1% year-on-year, mainly driven by the ris...

market analysis2025-09-12

CPI and unemployment benefits data push up Federal Reserve bets on interest rate

In Asian session on Friday, the U.S. dollar index remained weak, and the U.S. dollar weakened against major currencies such as the euro and the Japanese yen on Thursday. U.S. inflation data for August was slightly hot, and initial unemployment claims data were...

market analysis2025-09-12

A collection of positive and negative news that affects the foreign exchange mar

In the foreign exchange market, various news is like the guidance of a weather vane, which profoundly affects the trend of currency exchange rates. For investors, accurately grasping these positive and negative news is the key to making wise investment decisio...

market analysis2025-09-11

GBP/USD falls into consolidation ahead of key central bank resolution

XM Forex APP News - On Thursday (September 11), the pound/dollar exchange rate fluctuated in a narrow range around US$1.3521, and the trend was limited. The market is currently awaiting key U.S. inflation data, as well as a major policy meeting to be held by t...

CATEGORIES

News

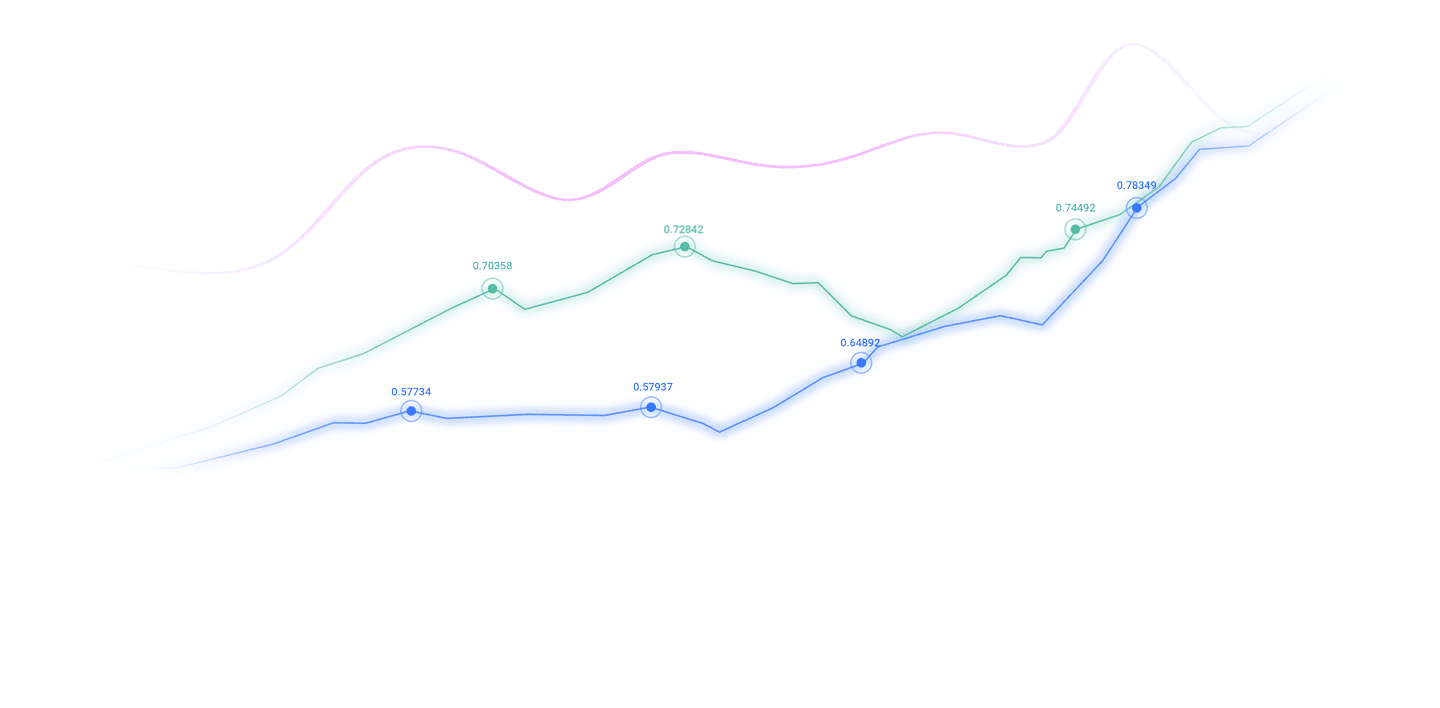

- 【XM Forex】--AUD/USD Forex Signal: Inverse H&S Points to Gains to 0.6350

- 【XM Forex】--EUR/USD Analysis: Future of Parity After Recent Losses

- 【XM Market Review】--USD/SGD Analysis: Trading Peril and Opportunities in High Pr

- 【XM Forex】--EUR/USD Forex Signal: Forecast Ahead of Key US Economic Data

- 【XM Decision Analysis】--Nvidia Recovers from a Sharp Drop, Meta at Record Highs,

- 【XM Decision Analysis】--GBP/USD Forex Signal: Double-Bottom Chart Pattern Forms